Finance Update - FY25, Q2

Finance Update offered by Salt House Treasurer, Irwin Dolobowsky

FY25, Q2 Updates

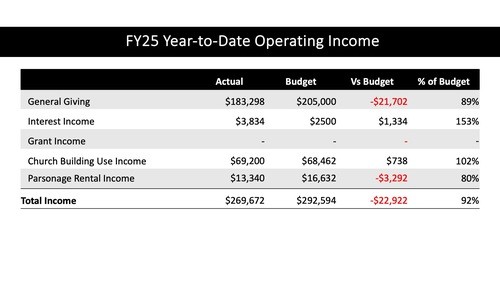

- Giving

- Best October Ever!

- Good December

- Tracking very close to FY24

- Stock Donations

Other Financial News

- New Counters. Thank you!

- FY26 Budget is process.

Primary Giving Options

- Joy Jar - No Fees

- Via Text or Online at https://www/salthousechurch.org/giving

- Associated Fees for Online & text giving paid by donor or Salt House.

- ACH: $0.25 per transaction.

- Credit/debit: $0.30 + 2.3% per transaction

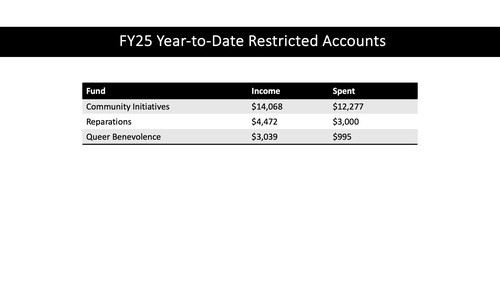

- Employer Matching for Microsoft Employees

- Microsoft will match gifts designated to Salt House Community Initiatives. These funds support outreach programs including supportive services to the surrounding Rose Hill community, disaster relief, and direct support for those who are experiencing homelessness. We currently support the work of the New Bethlehem Day Center with these funds.

- You can donate via the Microsoft Online Giving tool directly or, if you first give to Salt House and wish to have it matched by Microsoft, please indicate on your gift that the money is restricted to the Community Initiatives fund to ensure proper accounting.

- Gifting stock

- One of the easiest ways to give to Salt House Church is by gifting stock, which has considerable tax-advantages, especially if you have realized capital gains on your original investment.

- You will need to consult your tax adviser or investment adviser for advice specific to your financial situation. However, refer to Salt House - Giving for overview of how it works.

- As a general principle, Salt House will not hold stock for long-term investment purposes. All sales proceeds will be allocated to the General Giving fund unless the donor designates otherwise.

Questions? Want to Help?

Reach out if you have questions: treasurer@salthousechurch.org

Recent

Archive

2026

2025

September

November

2024

January

February

September

November

2023

2019

February

No Comments